Steueroase

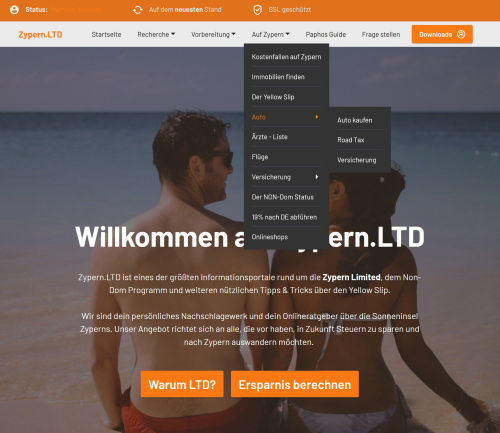

Zypern

Konstantes, warmes Klima, tolle Landschaften und günstige Steuervorteile für EU-Bürger - das macht eine Steueroase aus.

Zypern ist seit einigen Jahren wieder voll im Trend bei deutschen und europäischen Unternehmern. Die Insel im Mittelmeer wurde in kürzester Zeit zum legalen Steuerparadies in Europa. Wir erklären, warum.